FAQ

I am here to serve you through this time. Many of these questions will help put your mind at rest. Please do get in touch.

What is probate?

What is a significant asset?

For financial institutions, with cash assets, a significant asset is more of a variable; for example, at the lower end, some will ask for a Grant of Probate on sums in excess of £10k, whereas at some High Street banks the threshold may be as high as £50k – for most it lies somewhere in between.

What is the gross estate value?

What is the net estate value?

What is the chargeable value of the estate?

Where IHT is payable, then this will need to be done before the application for the Grant of probate can be made and within 6 full calendar months of the date of death.

How long does probate take?

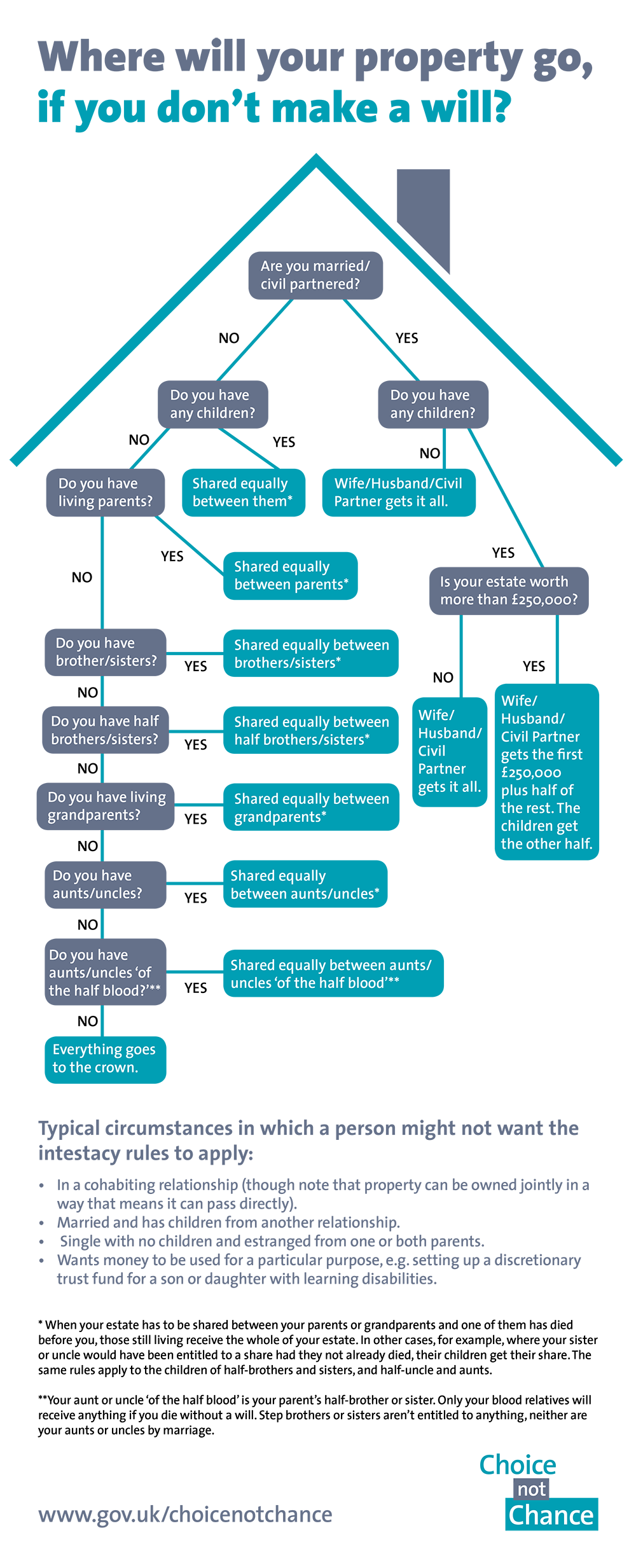

What are the laws of intestacy?

Usually, your spouse or civil partner will inherit the bulk of your estate (though unmarried partners won’t inherit anything).

Where will your property go, if you don’t make a will?

How much does probate cost?

This is likely one of the first questions you will have, also likely the question most providers will not want to answer upfront which is exactly why we are making this one a priority to cover.

Assuming a service taking full responsibility for valuing the estate, getting the grant of probate and dealing with the legal, tax, property and estate administration affairs including the distribution to the beneficiaries.

In my experience your typical High Street Solicitor will be looking to charge at least 2%of the gross estate value although I have seen this rise up to 5%, even in simple estates.

Third party introducers such as banks and insurance companies typically charge between 3-5%, again, regardless of complexity.

Some providers will offer to charge a fixed fee, usually based on the estimated gross estate value. If the actual gross estate value comes in higher there will almost always be a clause in the contract which allows your provider to increase the fixed fee – in effect it is not fixed at all. Conversely, if the gross estate value comes in lower than the estimate you are highly unlikely to see a reduction in your fees.

Some providers will offer to charge an hourly rate for their time in addition to further fees for every letter, phone call, and email. Time spent answering any questions you may have will be charged at the same hourly rate – at the time of writing the usual hourly rate is upwards of £300 +VAT and there is no upper limit on how many hours it might all take.

At My Probate Ltd the straight answer is, ‘it depends….…’. Frustrating I know but bear with me. It depends because we look at the work involved in administering each individual estate, in effect we are underwriting on a case-by-case basis. This approach respects the integrity of each individual estate and means that the costs are a fair reflection of the complexity or otherwise, involved in administering the estate. This is what we call ‘the common-sense filter’ and it protects the beneficiaries in passing on the

Typically, our clients are paying somewhere between 1.25% and 1.75% of the gross estate value – this only really varies in exceptional circumstances. So, if your beloved Maiden Aunt dies leaving a modest estate but making gifts to 67 beneficiaries, the work involved is significant and you might expect to pay 1.75%. However, if this same modest estate is left to you alone, then more likely it would be 1.25%. You get the idea.

Do bear in mind that the percentages quoted here are also likely subject to VAT.

Let's Start a conversation